Oasdi taxable wages calculator

OASDI and Medicare taxes are calculated as follows. The OASDI tax rate for.

Calculation Of Federal Employment Taxes Payroll Services

By law the OASDI tax must be automatically withheld from employee paychecks at a rate of 62 and employers are required to pay a matching 62 for a total tax of 124.

. For 2020 the maximum amount on which OASDI tax gets applied is 137700. For earnings in 2022 this base is 147000. As mentioned before the Social Security tax is 124 percent of your total earned income which you may pay entirely if youre self-employed and half of it if youre working for.

The Old-Age Survivors and Disability Insurance OASDI tax is an income-replacement program created to give workers a monthly reliable paycheck upon retirement. OASDI Social Security and Medicare Taxes. The HI Medicare is rate is set at 145 and has no earnings.

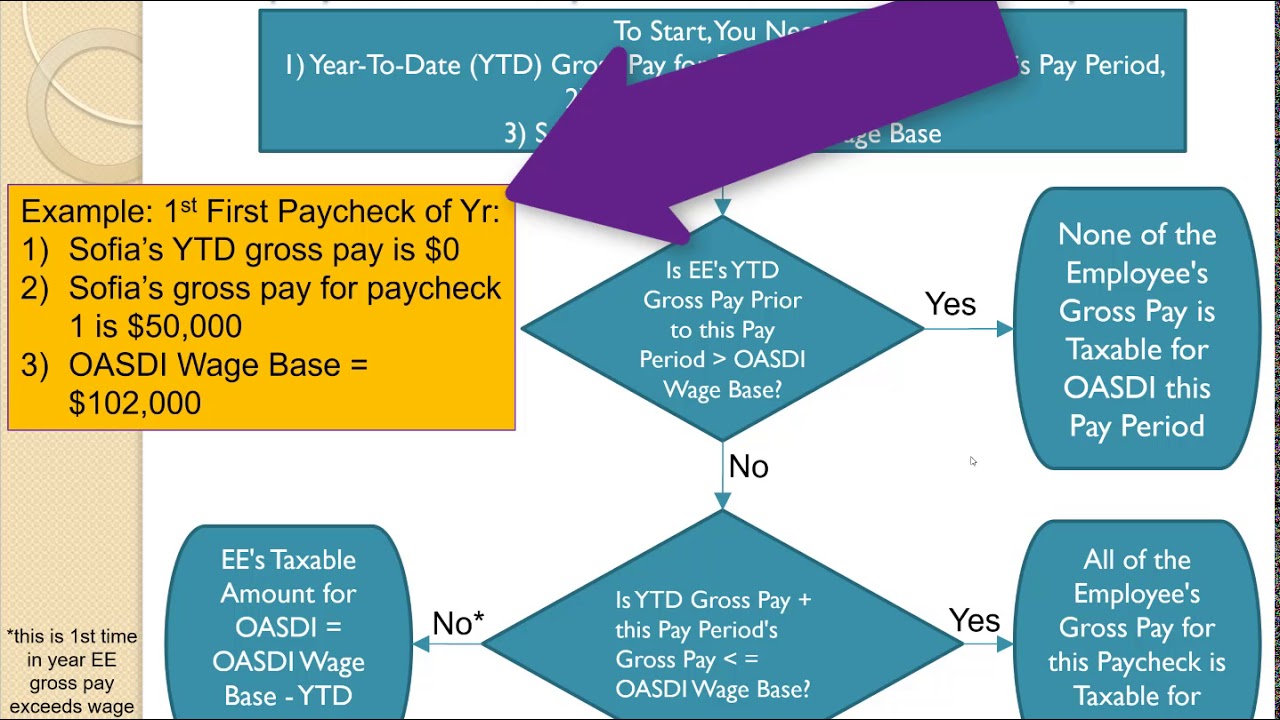

According to the Social Security Administration as of 2020 you would calculate OASDI tax at 62 percent of taxable wages up to 137700 for the year. Find OASDI - Taxable Wages on the payslip and multiply by 62 percent Jan 3 2022. Employee A has reached the SDI taxable wage limit of 128298 for the year.

This is a type of US tax which will be levied on your income that earned which will be used to fund the. How do you calculate taxable Medicare wages. Multiply your gross wages by the withholding rate.

Before you learn how much is deducted for OASDI you have to determine the amount of your pay. Calculate Your Gross Income. 3 Only a portion of Employee As fourth quarter wages are used to determine the SDI taxable wages.

OASDI Taxable Wages. In 2021 the OASDIs maximum taxable income was 142800. This amount is also commonly referred to as the taxable maximum.

35 rows The OASDI contribution rate is then applied to net earnings after this deduction but subject to the OASDI base. For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. The Tax Calculator uses Income tax information from the tax year 2022 to calculate the deductions made on a salary.

That means that the most that youll pay in OASDI tax is 853740 or twice that if youre self. Social Security Rate and Limit. Everyone knows that taxes come out of their paycheck but exactly which taxes may be less clear specifically the OASDI or OASDIEE tax listed on a pay stub.

The Old-Age Survivors and Disability Insurance program OASDI taxmore commonly called the Social Security tax is calculated by taking a set percentage of your. OASDI and HI for 2021. Find OASDI - Taxable Wages on the payslip and multiply by 62 percent.

The OASDI tax stands for the Old-Age Survivors and Disability Insurance. We call this annual limit the contribution and benefit base. If you earned 475 in gross wages and youre an employee 2945 will be withheld from your.

C For 2010 most employers were exempt from paying the employer. As a result additional OASDI taxes on salaries received in excess of 142800 are no longer. Lets say you earn.

The OASDI Taxable Wages have a wage limit of. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. If you worked 40 hours in.

Although we have tried to make this site accurate it is by no.

How To Determine Calculate Oasdi Taxable Wages

Calculating Oasdi Social Security Deduction Medicare Deduction Net Pay Youtube

Collection Of Deferred Social Security Tax Begins Jan 1 Wright Patterson Afb Article Display

Check Stubs Paycheck Employee Handbook Employee Handbook Template

Teks Lesson Plan Template Best Of 62 Free Pay Stub Templates Downloads Word Excel Pdf Doc Lesson Plan Templates Teks Lesson Plans Downloadable Resume Template

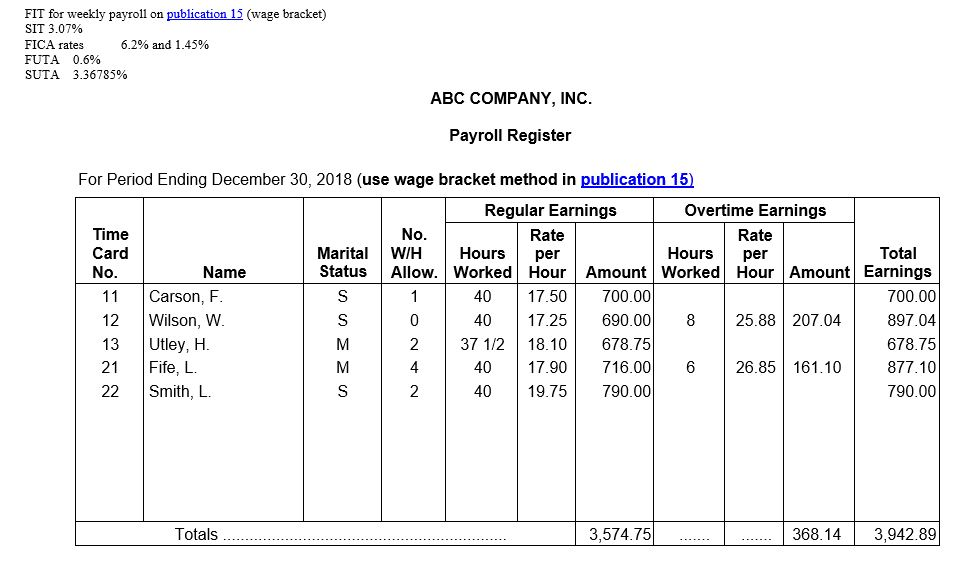

Solved Your Assignment Is To Calculate Oasdi Hi Tax Fit Chegg Com

Payroll Tax Accounting Ppt Download

Calculation Of Federal Employment Taxes Payroll Services

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Gross Up A Net Value Check

29 Free Payroll Templates Payroll Template Payroll Checks Payroll

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

Social Security Tax Calculation Payroll Tax Withholdings Youtube

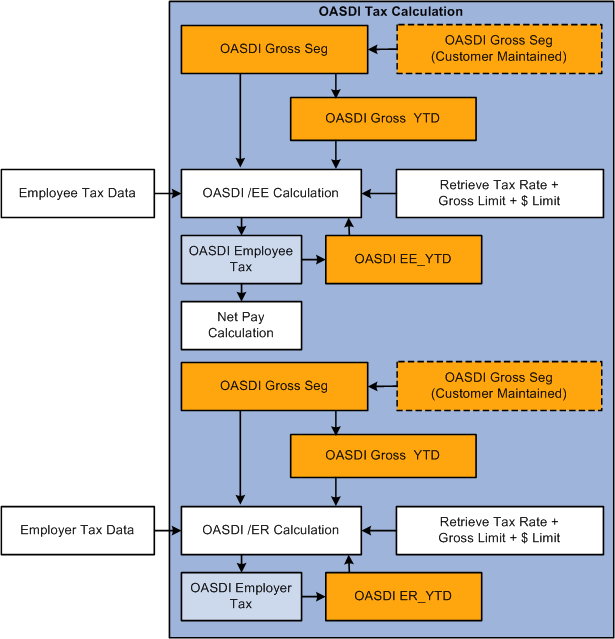

Peoplesoft Enterprise Global Payroll For United States 9 1 Peoplebook

Payroll Tax Accounting Ppt Download

Pay Check Stub Payroll Checks Payroll Payroll Template

Federal Income Tax Fit Payroll Tax Calculation Youtube